Payouts Onboarding

Increasing our paying customer count by 25% with improved onboarding.

BEFORE

AFTER

Project overview

Project Brief

Payouts is an app for businesses to pay other businesses with any payment method they want. Pay with your credit card even when your vendor doesn’t accept credit.

The Problem

A low # of customers that signed up where paying their first bill. There were a number of obstacles for the customers to overcome in a convoluted fashion in order to make their first payment. The company had already tried a marketing campaign to pay customers $200 who pay their first bill with poor performance results.

Goal

Above all else, get customers to pay a bill in their first session.

Responsibilities

Competitive research

User flow diagraming

Wireframes

High fidelity mocs

Tools

Figma

Process

First, discovery. With the objective clear, I began identifying different product design solutions for increasing our number of customers paying their first bill.

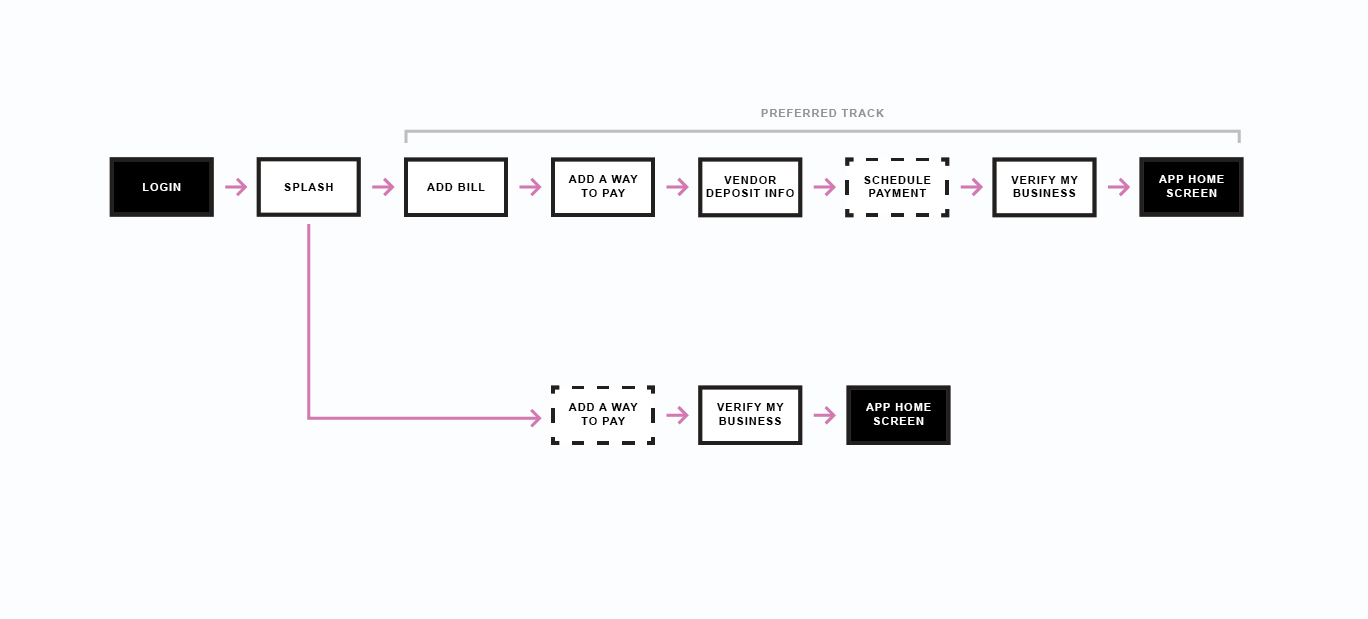

We could change the core product experience, modules, navigation relationship and connecting flows. The other option was to a linear onboarding experience ending in paying a bill before the customer gets into the app. After reviewing flow diagrams with the team, We ended up going with the linear onboarding flow to meet the timeline. We also identified that our learnings with the onboarding flow can then be applied to the application structure as we gather more paying customers.

From there I identified the steps a customer must take in order to pay their first bill. I did this through internal interviews with PMs and tech team. These were the core flows required for the customer to pay a bill.

Enter the bill information/ Upload bill

Add a payment method

Specify vendor information for payment

Verify business (compliance)

Scheduled the payment

From customer interviews I learned:

Not all customers had their vendors deposit information hand to get the money to them.

Not all customers passed business verification right away.

Not all customers bank account connection was instantaneous.

Customers wanted to see when the money will be debited from their account or card and when the customer will get it.

Not all customers who sign up have a bill to pay today.

To minimize these speed bumps in the customer experience we decided:

Allow the customer to schedule the bill payment.

At the end of the flow remind them if their business verification is in process, or their bank information is being checked that the payment will go through automatically once their info is cleared. They will receive email updates on this.

Allow customers to send a request for deposit information for a vendor by email.

Allow customers when scheduling the payment to visually see when the money will be taken from their account and when the vendor will receive the payment.

Allow customers to go down a secondary path where we still collect and verify their business information and prepare them for paying a bill when they have one. This path is visually less prominent to maximize our chances getting customers to pay a bill.

We thought about he app experience for when they finish the onboarding. I designed an action focused homepage to direct the customer to the most important thing they need to do next.

Outcome

We improved the first impression product experience for our customers with the introduction of this flow. We maximized the chances of a customer paying a bill in the first session. To the right, you can see the breakdown high level of each step for the happy path payment workflow>>

When the flow was fully implemented, we saw a 25% increase in paying customers in the first week.

-

Once the customer tells us they have a bill to pay, they have the option to upload their invoice or enter it manually.

-

Get the customer to connect their bank account or add a credit card to schedule this payment.

-

Entering the vendors bank deposit information and allowing the customer (if they don’t know it) to send an email request for the information.

-

Allowing the customer in calendar view to select when funds will be withdrawn, see when the bill is due, and when the funds will be delivered to the vendor.

-

Now that the customer is about to pay, we ask for the more sensitive business information needed to comply with US regulations.